In today’s digital landscape, understanding the intricacies of fraud detection is crucial for protecting financial assets. Command numbers like 8886052146 and 3109127426 serve as essential tools in identifying suspicious activities. By analyzing these identifiers, organizations can spot patterns and anomalies that might indicate fraud. However, the effectiveness of these measures relies heavily on the technologies and strategies employed. What advanced techniques could further enhance this vigilance against digital threats?

Understanding Digital Fraud: An Overview

Digital fraud, a pervasive threat in today’s online landscape, encompasses various deceptive practices aimed at financial gain.

You should familiarize yourself with different fraud types, such as phishing and identity theft, to better protect your assets.

Employing effective detection methods, like anomaly detection and machine learning, can significantly reduce your vulnerability.

Awareness and proactive measures are key to safeguarding your freedom in the digital realm.

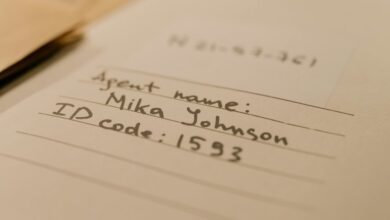

The Role of Command Numbers in Fraud Detection

Command numbers play a crucial role in fraud detection by providing specific identifiers that help track and analyze transactions.

By leveraging command effectiveness, you can streamline fraud prevention efforts.

Number analysis enables you to pinpoint suspicious patterns and anomalies, significantly enhancing your ability to respond to fraudulent activities.

This strategic approach empowers you to maintain financial freedom and security in a digital landscape.

Advanced Technologies for Identifying Fraudulent Activities

As technology evolves, organizations must adopt advanced methods for identifying fraudulent activities to stay one step ahead of cybercriminals.

Implementing machine learning algorithms allows you to analyze vast data sets quickly, detecting anomalies.

Coupling this with behavioral analytics helps you understand user patterns, flagging unusual behavior for further investigation.

Together, these technologies create a robust defense against emerging fraud tactics, ensuring security and trust.

Best Practices for Businesses and Consumers in Fraud Prevention

Fraud prevention is crucial for both businesses and consumers, and implementing best practices can significantly reduce the risk of falling victim to scams.

Enhance your fraud awareness through regular training and workshops. Prioritize consumer education by sharing resources and tips.

Use strong security measures like two-factor authentication. Stay vigilant and regularly review transactions to catch any suspicious activity early.

Conclusion

In today’s digital landscape, staying a step ahead of fraudsters is crucial. By harnessing command numbers and advanced technologies, you can effectively track and evaluate suspicious transactions. Remember, an ounce of prevention is worth a pound of cure; proactive measures can save you from potential losses. By prioritizing continuous monitoring and adopting best practices, you not only protect your financial assets but also contribute to a safer digital environment for everyone involved.